CNN’s recent analysis uncovers startling figures: Navy Federal Credit Union, America’s premier credit union catering to military personnel and veterans, turned down over half of its Black conventional mortgage applicants. Shockingly, an estimated 3,700 aspiring Black homebuyers faced rejection from the institution last year.

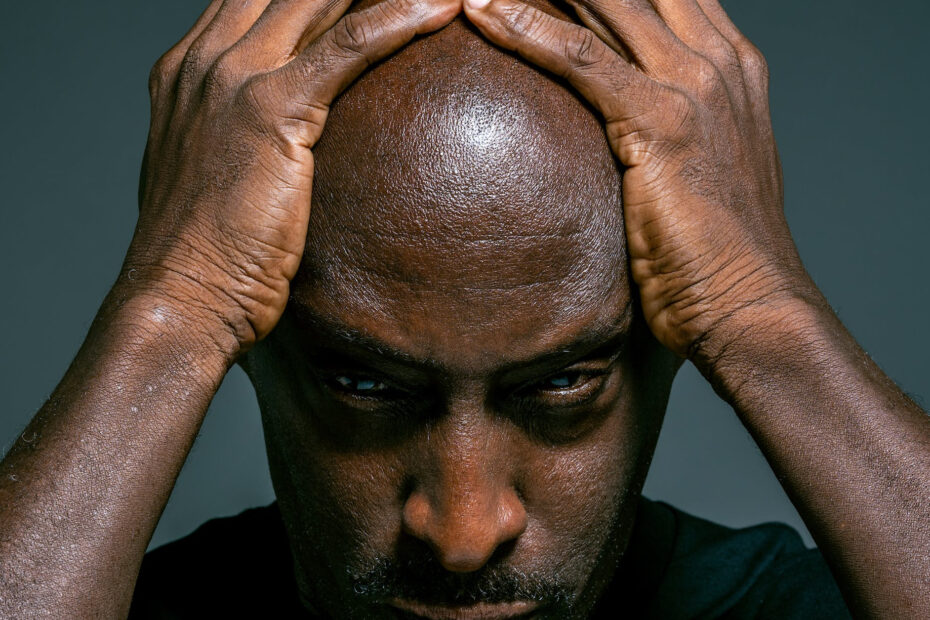

Owning a home represents an important aspect of wealth acquisition, alongside investing in stocks and various financial avenues. Nonetheless, the Federal Reserve’s data highlights a staggering reality. While 74.5% of white individuals are homeowners, less than half of Black individuals have achieved this milestone. This homeownership gap serves as a stark economic indicator. Thus, revealing the disproportionate underrepresentation of Black Americans in key financial aspects.

In their investigation, CNN examined the loan application data sourced from the Consumer Financial Protection Bureau’s Home Mortgage Disclosure Act. Their findings exposed Navy Federal Credit Union’s striking trend. The Credit Union is ranked first among the highest denial rate among the top 50 lenders in mortgage loan providers last year. Shockingly, the institution had a nearly 29-percentage-point gap in approval rates.

The disparity in loan approvals is a concerning reflection of a systemic issue. Despite similarities in income, debt, property value, down payment percentage, and location between white and Black loan applicants, financial institutions frequently reject applications from Black individuals. This disproportionate denial of financial opportunities persists, painting a troubling picture of bias within the lending landscape.

Navy Federal Credit Union

Navy Federal Credit Union was started in 1933, during the Great Depression. Seven Navy Department workers sought to support each other in achieving their financial objectives. Their vision involved creating a credit union that offered loans at reasonable rates and convenient terms. They aimed to promote financial stability by establishing a secure place to deposit savings and earn dividends, pooling their resources and inviting others to join.

What began as a small collective of naval employees united by common goals in 1933 has expanded to include officers, enlisted individuals from all military branches, veterans, Department of Defense employees, and their families. Presently, the institution serves the distinctive needs of the 13 million member-owners, and an asset base of 165 billion US dollars.

In 2003, Navy Federal Credit Union broadened its membership to include Navy contractors. Throughout its history, there were instances where the NCUA requested Navy Federal to merge with or absorb struggling credit unions. Members from these unions retained their membership in Navy Federal after the mergers, following the NCUA’s “once a member, always a member” policy. In September 2010, Navy Federal Credit Union announced its intention to merge with USA Fed, initiating joint operations under the Navy Federal banner from October 4, 2010.

Opening Up for Other Members

Expansions in membership marked significant milestones. In May 2008, the credit union extended its eligibility to encompass the entire Department of Defense, including active duty, retired, and reserve personnel from the Army, Navy, Marine Corps, and Air Force, as well as contractors and civilians within the Department. Subsequently, in March 2013, membership widened to include all Coast Guard members and employees. In 2020, the Navy Federal Credit Union expanded its membership to include Space Force members.

The organization’s growth led to expansions in its physical locations. In 2014, Navy Federal expanded its Vienna headquarters, now accommodating 3,900 employees as of December 2021. Membership surge also prompted expansions at the Pensacola location in 2015, housing 7,800 employees, and the Winchester Operations location in 2019, employing 2,000.

As of 2021, Navy Federal stands as the largest credit union in the United States, boasting total assets nearly three times greater than the second-largest US credit union.

The Approval Rates by race in 2022

| Racial Group | Mortgage Approval Rate |

| Whites | 79% |

| Asians | 69% |

| Native Americans | 64% |

| Latinos | 56% |

| Blacks | 48% |

Response to the CNN Investigation by the Navy Federal Credit Union

Navy Federal spokesperson Bill Pearson issued a statement in defense of the credit union’s lending practices, emphasizing their commitment to fair and equal lending standards.

“Pledging a dedication to equitable lending practices and strict compliance with all fair lending regulations, Navy Federal Credit Union prioritizes employee training, fair lending statistical assessments, third-party evaluations, and comprehensive compliance reviews within our lending protocols. These measures are integrated to uphold fairness consistently across all aspects of our operations.”

Bill Pearson, Navy Federal Spokesperson

Pearson from Navy Federal argued that CNN’s analysis didn’t consider crucial factors like credit score, available deposits, and prior relationships with the lender, which are pivotal for mortgage approvals.

However, Navy Federal declined to provide additional data, such as borrowers’ credit scores, when requested by CNN. A significant portion of Navy Federal’s denials wasn’t solely due to credit history.

Current Status

While Navy Federal engages a substantial number of Black applicants—around a quarter of its conventional mortgage applicants are Black, and nearly 18% of its loans go to Black borrowers—there’s a significant racial gap in approval rates. Despite increased applications from Black borrowers seeking conventional mortgage loans, most face denials from the credit union.

Why The Disparities among Black Ethnic Group?

Mortgage lending experts and fair housing advocates expressed surprise at the significant racial disparities in Navy Federal’s approval rates. This raises serious concerns about the institution’s lending practices. Lisa Rice, President and CEO of the National Fair Housing Alliance, described the identified racial gaps in Navy Federal’s lending as “some of the largest I’ve seen.”

Rice emphasized, “That’s a stark disparity. It’s uncommon to witness a lender denying more loans than it approves.”

These experts highlighted Navy Federal’s racial discrepancies as an extreme example of a broader nationwide issue. The gap in approval rates between White and Black borrowers has notably widened in recent years within the credit union, mirroring trends seen across all lenders.

Furthermore, the homeownership disparity between White and Black Americans is presently larger than pre-Civil Rights era levels, significantly contributing to wealth disparities between White and Black families.

Disappointed Navy Federal Members

Bob Otondi, a Black business owner from Texas, had his mortgage application rejected by Navy Federal in 2021. He got approval from another lender within two weeks, which left him puzzled.

He told CNN, “The rejection didn’t make sense. I thought it might be because of race, but I couldn’t prove it.”

Last year, Navy Federal turned down around 3,700 Black applicants for home mortgages, potentially stopping them from owning homes when interest rates went up. They also approved fewer Latino borrowers compared to White borrowers.

During the summer of 2021, Bob Otondi discovered what he deemed his “dream house” while house hunting. Nestled in a lakeside neighborhood within a Dallas suburb, the three-bedroom home boasted an inviting open kitchen, a spacious backyard complemented by a pool, and, notably, fell within a sought-after school district where Otondi’s son had longed to attend high school.

With his bid for the home accepted, Otondi anticipated a seamless mortgage process with Navy Federal. As a relative of Navy servicemembers and a long-term customer of the credit union, he had been pre-approved and had a track record of successfully paying off previous Navy Federal vehicle loans. Moreover, he had meticulously planned a downpayment that exceeded 20% of the home’s value.

However, just before the scheduled purchase closing, Otondi received distressing news: Navy Federal denied his application. A standard form letter cited his income as insufficient to cover his debts.

So What exactly Happened?

The sudden denial left Otondi baffled. He provided documents to CNN showing an income exceeding $100,000 annually from his logistics business. More so, his credit score surpassed 700. He claimed to have minimal outstanding debts.

Amid the frenzy of the pandemic-era housing market, Otondi feared losing the home. “I was stunned, shocked, and hurt,” he confessed. He had already envisioned decorating the house with his children, making the news of potential loss heartbreaking. “To return home and tell them, ‘we lost the house?’ It was devastating,” Otondi expressed.

Fortunately, his realtor, Angela Crescini, connected him with another mortgage lender who approved his loan within two weeks, ensuring the successful purchase of the house.

Crescini, the realtor, voiced her disbelief, stating, “There was no legitimate reason he shouldn’t have gotten the loan” from Navy Federal. “How could one lender process a loan within 15 days while the other couldn’t do it at all? It just didn’t sit right with me.”

Reasons for the Widening Gap

Advocates have been urging lenders, such as Navy Federal, to enhance automated underwriting systems to determine mortgage application approvals or denials. The aim is to minimize racial disparities in lending practices.

Several banks have adjusted their underwriting processes by considering additional data, like a rent payment history, to mitigate racial gaps in creditworthiness assessments. Pearson, the Navy Federal spokesperson, mentioned the integration of rental history into their underwriting process but didn’t offer specific details.

Experts highlighted the possibility that Navy Federal’s member base. It consists of servicemembers, veterans, and their families, might present a distinct financial profile compared to the broader public served by larger banks. This divergence could contribute to observed racial disparities.

Unlike major banks, Navy Federal isn’t bound by the Community Reinvestment Act, which promotes lending in low to middle-income neighborhoods. While federal regulators scrutinize banks’ lending under this act, credit unions and other non-bank lenders are exempt.

Advocates and banking groups have long advocated for changes to the law to mandate credit unions to comply with similar regulations. Rice, the fair housing advocate, expressed concerns, stating,

“Our legislators have given a huge pass to credit unions, assuming they’re meeting the needs of their members.”

The Role of Loan Officers in Disparities

Loan officers, as highlighted by Sara Pratt from the law firm Relman Colfax, have been implicated in perpetuating racial disparities in mortgage lending. Pratt, who previously led civil rights enforcement at the U.S. Department of Housing and Urban Development, indicated that some loan officers might offer more assistance or flexibility to White borrowers compared to Black applicants.

Pratt explained that a loan officer might go the extra mile for certain applicants, advising them to pay down credit card balances. Or increase their down payments to secure approval. However, she noted a disparity in how this advice is extended. Further suggesting that White borrowers might receive more proactive guidance than Black applicants.

While Pratt didn’t provide direct evidence of such practices at Navy Federal, she stressed that the disparities in approval rates should prompt lenders to justify them

Under federal law, lenders don’t need to intentionally engage in racism to violate fair lending rules. Even unintentional “disparate impact” on minorities can lead to discrimination claims.

Pratt emphasized the detrimental impact of discrimination on business, stating,

“It’s detrimental for business because, in many cases, genuinely qualified individuals are overlooked, leading lenders to miss out on potential loans.”

Sara Pratt, the law firm Relman Colfax,

In response, Pearson from Navy Federal highlighted the credit union’s pride in facilitating a substantial portion of loans for Black borrowers. He mentioned that over half of their branches are situated in “minority communities.” Emphasizing the credit union’s member-focused approach, he reiterated their commitment to expanding homeownership access. Majorly by offering tailored financial guidance to each member based on their unique needs.

Some Ray of Hope

While the denial rate remained substantial, Navy Federal allocated approximately 18% of its conventional loans to Black borrowers. This is a higher proportion than any other lender. Despite this, they granted loans to 48.5% of Black applicants, contrasting with the 77% approval rate for white applicants.

CNN clarified in the article that its analysis “does not confirm discriminatory practices by Navy Federal against borrowers.” However, it underscores substantial discrepancies in the credit union’s approval rates across various racial groups. Further highlighting more pronounced racial disparities compared to many other major financial institutions.