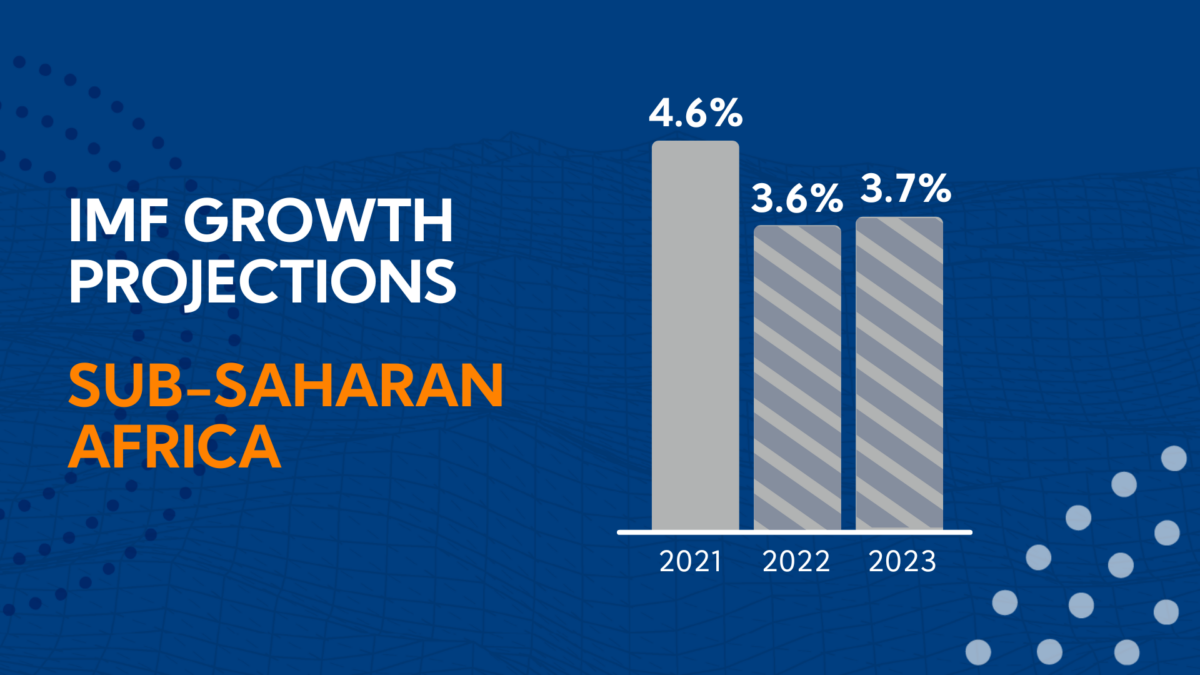

The International Monetary Fund (IMF) has upgraded Sub-Saharan Africa’s GDP growth to 3.8% for the current year, a positive shift from the downward revision of 3.3% made in October. According to the latest World Economic Outlook in January 2024, the region will experience further growth, consolidating at 4.1% in 2025. The positive outlook results from a reduced negative impact of earlier weather shocks, with gradual improvements in supply issues.

- In the October 2023 revision, the lender forecasted the region’s growth at 4.0% for the current year.

- The projection suggests Sub-Saharan’s growth will settle at 4.1% in 2025.

In the October 2023 revision, the IMF initially projected the region’s economy to grow at 4.0% this year. However, a recent downward revision of 0.2 percentage points remains a reality. This is primarily due to a weaker projection for South Africa. The decline emanates from increased logistical constraints, particularly in the transportation sector.

On a global scale, the IMF estimates a 3.1% growth in the economy for 2024. Also, a further increase to 3.2% in 2025. The positive outlook surpasses the October revision, driven by greater-than-expected resilience in the United States. Other markets include several large emerging market economies and fiscal support in China.

Despite the optimistic projections, the global forecast for 2024–25 remains below the historical average of 3.8%. Elevated central bank policy rates, and withdrawal of fiscal support amid high debt, remain factors hindering global economic growth.

The IMF also notes a faster-than-expected decline in global headline inflation. Thus, anticipate a decrease to 5.8% in 2024 and further down to 4.4% in 2025. It reflects a revised downward forecast for 2025.

Policy Makers Role in Upgraded GDP Growth to 3.8%

After the IMF upgrades GDP growth in Sub-Saharan Africa, it has urged policymakers to effectively manage the final descent of inflation to the target. The process involves adjusting monetary policy to address underlying inflation dynamics. Particularly when wage and price pressures visibly diminish. Hence need for a less restrictive stance.

Simultaneously, the IMF acknowledges that, as inflation recedes and economies become more resilient to fiscal tightening, fiscal consolidation is key. It helps rebuild budgetary capacity for handling future shocks. Also, generates revenue for new spending priorities, and mitigates the escalation of public debt.

The IMF emphasizes that implementing targeted and carefully sequenced structural reforms is crucial. These reforms would enhance productivity growth, ensure debt sustainability, and expedite the progression towards higher income levels.